Scalping is a quick trading method used in the crypto field. Traders who use crypto scalping strategies aim to make large profits by taking advantage of tiny price moves.

In this article, we help you understand how scalping works in the crypto markets. We also share tips for making more money from it and discuss the important tools and signs that help traders make fast decisions.

Best Crypto Scalping Strategies

When scalping crypto, scalpers aim to make quick profits, and having a solid plan for when to sell is necessary. Here are the main scalping crypto strategies that help them increase the earnings:

Range Trading

Range trading is a crypto scalping strategy commonly used by traders who look for opportunities within a cryptocurrency’s predictable price movements.

When a crypto asset like Bitcoin or Ethereum shows a pattern of bouncing between a high price (resistance) and a low price (support), it’s said to be trading within a range. You can read about cryptocurrency’s advantages and disadvantages if you want to learn more.

Here’s how you can put a range trading strategy into practice:

1. Identify the Range

Use technical analysis tools like horizontal lines on a price chart to mark the upper and lower boundaries of the price range. The top line is the resistance, where the price peaks before dropping again. The bottom line is the support, where the price dips to before bouncing back up.

2. Set Entry Points

Once you’ve established the range, you can plan to buy or ‘go long’ on the crypto asset near the support level, as that’s where the price is considered to be more attractive and likely to rise.

Conversely, you might plan to sell or ‘go short’ near the resistance level, as the price is higher and might soon fall.

3. Determine Exit Points

Before entering a trade, decide how much you’re willing to risk and set your stop-loss orders accordingly. A stop-loss is a predetermined price at which your trade will automatically close to prevent further losses.

Also, set your take-profit levels just below the resistance when buying and just above the support when selling to lock in profits.

4. Monitor the Market

Range boundaries can break. If there’s an event or news that affects the market sentiment, the price might break through the support or resistance levels. Be ready to adjust your strategy if the market no longer respects the established range.

5. Manage Risks

Don’t put all your capital into a single trade. Spread your risk by allocating only a portion of your funds to range trading. Also, be aware that ranges don’t last forever. A breakout or breakdown out of the range can lead to significant price moves in either direction.

6. Stay Informed

Keep an eye on market news and events that could impact the price of the crypto asset you’re trading. Major announcements or changes in regulations can lead to volatility that might disrupt the range pattern.

Bid-Ask Spread

The bid-ask spread is like the gap between what buyers are willing to pay for something and what sellers want to get for it. Some traders make money by taking advantage of this gap, quickly buying and selling for small profits.

Here’s a more practical look at how the bid-ask spread can be used by scalpers:

1. Understanding the Spread

Before you can profit from the bid-ask spread, you need to understand how it works. The bid price is what buyers are currently willing to pay, and the ask price is what sellers are willing to accept.

The difference between these two is the spread. For example, if the bid is $10.00 and the ask is $10.05, the spread is $0.05.

2. Monitoring the Market

When scalping crypto, scalpers need to monitor the market closely and be ready to act quickly. They watch for changes in the bid and ask prices and look for opportunities where the spread is wider than usual, which could indicate a chance to profit.

3. Making Quick Trades

When a scalper sees an opportunity, they buy at the bid price and immediately turn around and sell at the ask price, pocketing the difference. This requires a high level of precision and timing, as market conditions can change rapidly.

4. Managing Costs

Important to remember that each trade comes with transaction costs, such as broker fees and commissions. Scalpers need to make sure that their potential profits from the bid-ask spread are greater than these costs.

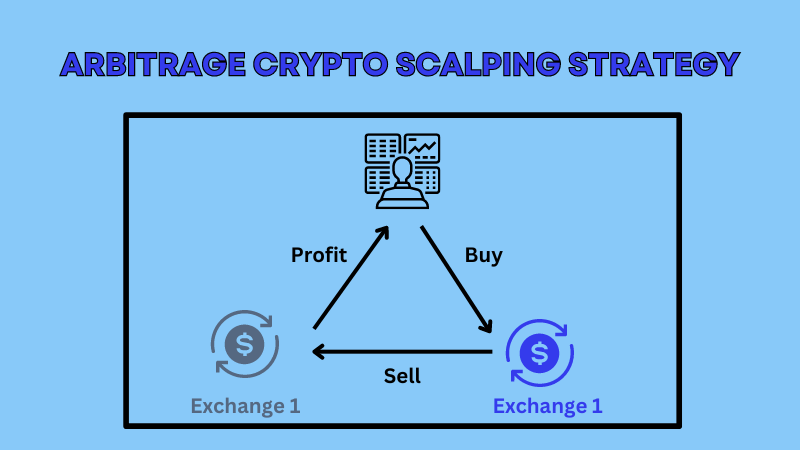

Arbitrage Crypto Scalping Strategy

Arbitrage strategy takes advantage of price differences for the same cryptocurrency on different exchanges. For instance, Bitcoin might be selling for $40,000 on Exchange A but at $40,050 on Exchange B.

Scalpers, or traders who execute this strategy, can buy Bitcoin at the lower price on Exchange A and then quickly sell it on Exchange B to make a profit of $50 per Bitcoin.

Here’s a step-by-step guide to executing a cryptocurrency arbitrage:

1. Identify the Opportunity

Use tools or websites that compare prices of cryptocurrencies across various exchanges to spot the price differences.

2. Check for Fees

Before you jump in, ensure you account for any trading, withdrawal, and transfer fees that might eat into your profit.

3. Execute Trades Quickly

Once you’ve confirmed a profitable opportunity, buy the cryptocurrency at the lower price on one exchange. Immediately transfer it to the other exchange where the price is higher.

4. Sell at a Higher Price

As soon as your cryptocurrency arrives at the second exchange, sell it at the higher price.

Here are some practical tips:

- Arbitrage opportunities can disappear quickly as other traders might exploit the price difference, or the market adjusts. Automated trading bots can help execute trades faster than manual trading.

- Ensure that both exchanges have enough volume so that your trades don’t impact the market price, which could negate your arbitrage opportunity.

- Different cryptocurrencies have different transfer times. Choose ones that move quickly between exchanges to capitalize on the arbitrage opportunity before it vanishes.

- Be aware of the regulatory environment in your jurisdiction, as moving funds between exchanges, especially across borders, can sometimes raise legal questions.

- Profits from arbitrage might be taxable. Keep records of your trades and consult with a tax professional to ensure you’re compliant with tax regulations.

Effective Scalping Crypto Tools

Scalpers are traders who make quick, small trades to profit from tiny price changes. To do this effectively, they use various tools and simple indicators:

Moving Averages

This helps scalpers see the average price of a cryptocurrency over a certain time, which makes it easier to spot trends without getting confused by short-term price swings.

Volume

By looking at how much of a cryptocurrency is being traded, scalpers can tell if a price move is strong and likely to continue, which might be a good chance to make a trade.

RSI (Relative Strength Index)

This tool helps scalpers figure out if a cryptocurrency is priced too high or too low, suggesting when it might be time for the price to change direction — perfect for quick trades.

MACD (Moving Average Convergence Divergence)

MACD indicator helps scalpers see how the momentum of a cryptocurrency’s price is changing, which can hint at when to enter or exit a trade.

For scalpers, using these tools smartly can lead to profitable trading, but it’s important to make quick decisions, time things right, and really understand the market.

Market Analysis and Insights

Market analysis is important if you want to make money trading, especially for scalpers who trade very fast. They need to get the latest market information quickly, and it has to be right because even small changes can affect whether they make or lose money.

Real-time Market Data

Scalpers need to see market data right away to make quick decisions. They make money by trading fast, sometimes in less than a second.

They need to know the latest prices, how much is being traded, and what orders are out there. This helps them stay up-to-date and act quickly when the market changes.

Analytical Tools

Scalpers use different tools to guess where prices will go next, even if it’s just a small change.

These tools include:

- Technical indicators. These helpers use past price data to suggest when to buy or sell. Examples are moving averages, Bollinger Bands, and the RSI.

- Chart patterns. By spotting certain shapes on price charts, like flags or triangles, scalpers can get a clue about the next price move.

- Trade signals. Computers can be set up to tell scalpers when to buy or sell based on rules they choose.

- Algorithmic trading. Some scalpers have computer programs that can make trades for them by following a set plan.

Educational Resources for Cryptocurrency Scalping

Scalping in trading requires quick action, careful timing, and staying informed. There are plenty of learning materials for anyone wanting to learn this technique, whether you’re new or experienced.

Tutorials and Guides

If you’re new to trading and want to learn about scalping, there are many online resources to help you. Cryptocurrency scalping is a quick trading style where you buy and sell in a short time.

Here’s what you can learn from these resources:

- What scalping is and its basic ideas.

- Different types of orders and how to use them quickly.

- How to look at price charts and spot short-term trends.

- How to make fast decisions and manage your time.

These resources often use clear videos and pictures to explain things simply, so you can understand and start using scalping strategies more easily.

Webinars and Workshops

Webinars and workshops are great for hands-on learning about trading. They’re run by expert traders and analysts who can show you what’s happening in the markets right now and how to make trades.

You can ask questions and get answers on the spot. If you’re already trading and want to get better at quick trades, or “scalping,” these sessions can teach you more advanced skills. They feel like you’re really there in the trading world.

Remember to sign up early because some of these events need you to register before they start. Keep an eye on the schedules from trusted trading education groups so you don’t miss out.

Community Forums

Scalpers can learn a lot from each other by talking and sharing tips on online forums. These places are great because:

- Scalpers can teach and help each other.

- They can discuss new scalp methods and what’s happening in the market.

- They can meet other traders, which might lead to working together.

Being active in these forums can help scalpers get better faster. They can learn things that are hard to find in books or classes.

Conclusion of Crypto Scalping Strategies

Crypto scalping strategies are used to make small profits from minor price changes. There are different scalping methods and specific tools to help traders make quick decisions. Essentially, with the right strategies and tools, traders can make the most of small price movements in the crypto market for potential profits.

FAQ – Crypto Scalping Strategies

What is scalping in crypto trading

Scalping is a strategy where traders make quick, small trades to profit from tiny price changes in the cryptocurrency market.

What are some common scalping strategies

Common strategies include range trading, taking advantage of the bid-ask spread, and arbitrage between different exchanges.

Do I need special tools for scalping

Can anyone do scalping in crypto

While anyone can try scalping, it requires quick decision-making and a good understanding of the market. It’s more suited for experienced traders.

Is scalping profitable

Scalping can be profitable, but it’s risky and requires a solid strategy and continuous market analysis.