ISO 20022 is a standard for exchanging financial messages between different applications, such as brokers or trading platforms. It defines how to encode data in XML format exchanged over networks without losing information. The Iso20022 crypto specification was developed by the Financial Services Standards Board, which consists of representatives from banking institutions, securities exchanges, clearing houses, payment systems providers, software vendors, and other interested parties.

ISO 20022 specifies two types of message formats: structured text and binary-encoded value. ST contains human-readable content, while BEV encodes this same content into machine-readable form. This allows for a more efficient transfer of data across network connections. In addition, the use of these standards reduces the risk of loss during transmission because they designed with redundancy built-in. For example, if one part of the message fails, another will take its place.

The most common application of ISO 20022 is the encoding of stock market transactions. Stock markets have been using standardized messaging protocols since at least the 1980s when the National Association of Securities Dealers introduced NASDAQ’s Market Data Transmission Protocol. Since then, many companies have adopted similar methods for their own internal communications.

How it works

The system uses more than 200 characters, which combined together with various symbols and numbers.

– ISO20022 crypto

1. The first letter of the bank id will be followed by a set of alpha characters used to identify different types of banks that may exist in one country or internationally. For example, if your credit card issued by Citibank NA (North America), the first letter – “C.” If your credit card was issued by Citibank UK, it would start with a capital “U” because they are registered in Europe instead.

2. The next set of letters signifies what type of institution issues the bank id, for example, “IBAN” or “SWIFT.”

3. Following this are the numbers that correspond to how your bank account registered with the financial institution. This means all of your banking information will be kept safe and secure by following these standards set in place by banks themselves when developing this system.

4. The next set of letters indicates the type of account, for example, “name” or “company.” This is followed by your bank id’s version number and then finally a checksum digit which ensures that any changes made along the way to your bank account details are actually valid.

5. This is a complicated system, but it’s crucial for safeguarding all of the information you store in your banking institution. It may take some time to get used to how this works, and there will be times when things don’t go 100% as planned. However, this a highly-respected system used by over 200 countries in the banking community across the world.

Iso 20022 crypto list

The following is an iso 20022 crypto list of organizations that support the standard.

1. Algorand

2. Ripple

3. ISDA

4. SWIFT

5. XDC

6. FIX Protocol Limited

7. ISITC

8. Visa

9. Omgeo

Applications of 20022 cryptos?

There are several areas to implement ISO 20022 cryptos. Some examples include:

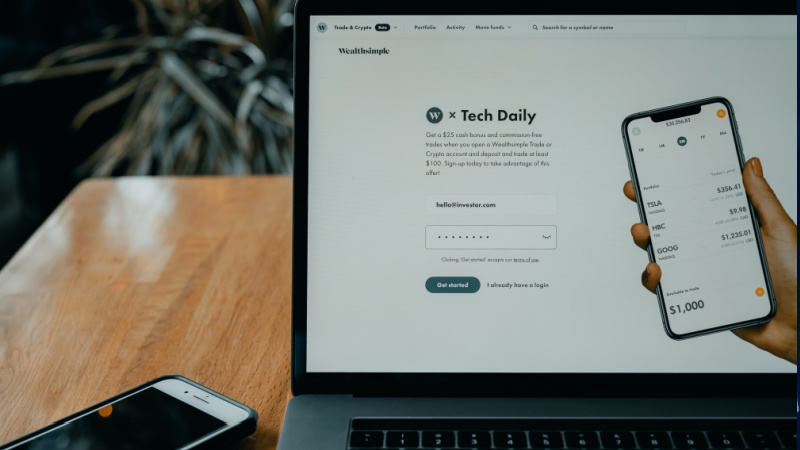

- Trading platform integration

- Brokerage firm integration

- Payment gateway integration

- Clearing house integration

- Settlement system integration

- Trade finance provider integration

- Bank reconciliation service integration

- Risk management solution integration

- Compliance requirements

How do I know a company supports ISO 20022 cryptocurrency?

If your company has any business relationship with banks, brokerages, trade finance firms, etc., chances are good that your company already supports some type of ISO 20022 cryptocurrency. You should check with them first, though!

If not, here’s how you find out:

1. Check with your bank or brokerage firm. Many financial institutions now offer APIs so that third-party developers can integrate their applications directly with those institutions’ back-office functions. Your institution may provide such an API.

2. Contact your trading partners. Ask them whether they support ISO 20022 crypto. If they don’t, ask them why not. Most likely, it’s due to a lack of demand from customers.

3. Search online. Numerous websites provide information on various types of ISO 20022 crypto, including lists of supported exchanges, brokers, clearing houses, settlement systems, etc. Is there anything else I should be aware of?

Yes. Here are two things to keep in mind:

The ISO 20022 crypto specification developed by the International Standards Organization, headquartered in Geneva, Switzerland. It is therefore vital to understand that this document governed by Swiss law. This includes the fact that all contracts entered into between parties based upon the ISO 20022 crypto specification must comply with Swiss contract laws. In other words, if you enter into a transaction using ISO 20022 crypto, then you will have to abide by Swiss law when entering into that transaction.

Also, note that the ISO 20022 crypto spec only covers transactions involving currencies. Transactions involving commodities, securities, derivatives, foreign exchange rates, etc., are outside its scope. Therefore, if you plan to use ISO 20022 crypto for these purposes, make sure you consult with your legal counsel regarding compliance issues.

The benefits of using crypto ISO 20022

Crypto 20022 ISO is designed to provide a secure messaging system that cannot be hacked like traditional methods because it uses XML-based data interchange format to implement a messaging system that is not vulnerable to traditional forms of attack.

ISO20022 crypto provides end-to-end protection with encryption, authentication, and digital signing. This means any message sent using ISO 20022 will only be able to be read by the sender and receiver unless they don’t know the password.

Iso 20022 also provides a way to make sure that only the sender and receiver will read any message even if it was intercepted.

In addition, ISO20022 crypto also designed so that messages cannot altered in transit without detection. Digital signatures used for this purpose.

So what does this mean for us as traders? Well, we need to start thinking about our own internal processes and procedures. We need to ensure that we’re following best practices within our organization. And we need to think about ways to improve our existing processes and procedures.